As seen in the example, the R% rose above “-20” and then hovered there during the uptrend. There is also a point to be made about the “-50” mid-line – Prices forcefully crossed this mid-line at the beginning of the trend and continued to the “-20” threshold. The trend concluded after the R% forcefully crossed the mid-line again, but this time, it headed directly to the “-80” territory. In this chart, the Williams Percent Range oscillator has a setting of “14” and is presented on the bottom portion of the above “15 Minute” chart for the “EUR/USD” currency pair.

These levels can be adjusted depending on the security’s characteristics. Forex — the foreign exchange market is the biggest and the most liquid financial market in the world. Trading in this market involves buying and selling world currencies, taking profit from the exchange rates difference. FX trading can yield high profits but is also a very risky endeavor. The Williams’ Percent Range indicator shows overbought and oversold market conditions.

The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners. Let’s shift gears and look at a real-time trading example from a different perspective. Enjoy discovering the usefulness of this tool on your demo system, and then employ it in a real-time setting for consistent gains.

We have paired the R% indicator with the Average True Range indicator and Bollinger Bands in this example. The “GBP/USD” currency pair is plotted on a “4-Hour” timeline, and a serious downtrend has developed. A sudden increase in an ATR’s value is an alert that ranging price behaviour is about to change. They contract during ranging periods and expand suddenly when a shift is about to occur. For example, if the market is in an uptrend, but starts to pull back, traders may be looking for an opportunity to join the longer-term trend. When the indicator dips below the -80 level and then pops back above it, it has reached the oversold indication, and then reentered the overall norm.

As with any oscillator, one should wait until actual pricing behaviour confirms the reversal. Beginners often make the mistake of trying to guess peaks and valleys for price swings. However, the sage advice from Williams and other trading veterans is to wait until confirmation from prices or insights gleaned from other technical indicators or recognizable patterns. Once again, your practice sessions are the best avenue for learning the nuances of the Williams %R indicator. While practising, develop a step-by-step William Percent Range strategy and fine-tune it until you are comfortable enough to try it out in real-time with real capital. Confidence and patience are the name of the game, and this trading strategy will help you keep your emotions in check, the advice every veteran will give you when asked.

Adding a moving average to increase effectiveness

From beginners to experts, all traders need to know a wide range of technical terms. Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California life, accident, and health insurance licensed agent, and CFA. She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans. This means that prices aren’t hitting the high end of their range as quickly as they did before and that the bullish momentum might be running out of steam.

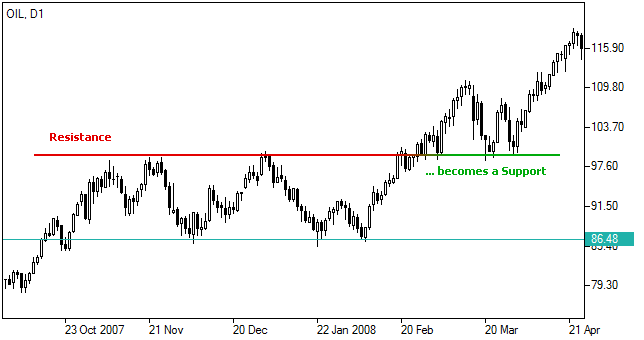

Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. But whether it is telling you to trade with the trend or get in on a reversal can be challenging to interpret. If the market repeatedly crosses above -20, and then fails to do so the next time it tries, upward momentum is decreasing. If, during a downtrend, the indicator repeatedly crosses below -80, the downtrend is strong. You can use the Williams’ Percent Range indicator to help you spot trend reversals.

From basic trading terms to trading jargon, you can find the explanation for a long list of trading terms here.

One way you can frame situations like the one above with more context is by using additional indicators, drawing tools or price patterns on your charts. If you are getting the same signal from more than one, you may have a stronger setup and a better idea of what is unfolding. But actually, you should wait for price to pass back into the «normal» range from the overbought or oversold area before you get into a trade. You might think the moment you see the line in the indicator crossing below -80, you should buy since conditions are oversold. Likewise, you might think that the instant the line crosses above -20, you should sell since conditions are overbought. As a trader, we recommend spending a considerable amount of time experimenting with it in a demo account.

Explore the markets with our free course

This oscillator attempts to convey pricing momentum direction changes. Typical oversold and overbought conditions are borne out by Green circles, and line crossings, provided by the additional SMA, help to confirm these trading signals. The Williams Percent Range is viewed as a “leading” indicator in that its signals foretell that a change in trend is imminent. Forex traders favour the Williams Percent Range indicator because of its ability to foretell reversals one to two periods ahead of time. Furthermore, the slope of the moving average had been lowering for quite some time, and as it went below the minus 20 level, it sent the market much lower. In fact, there was even a signal to get out of the short position due to the indicator dropping into the range below the minus 80 handle as it becomes oversold.

When the market is trending upward, the indicator may rise above -20. When you see the line moving above -20, this indicates that the market is overbought. First, the Williams %R indicator works best when the price of an asset is trending. As always, as a trader, you don’t need to know how it is calculated. All you need to know is how to implement it on the trading platform.

When you plot the indicator on your chart, you will select a period. The formula looks at the highest price and the lowest price within that time period along with the most recent Close. The Williams %R typically shows the levels of the relative close of a financial asset compared to the highest level of the period under consideration.

Also, the indicator can remain in the oversold and overbought levels for long. A good way to use it to combine the percent range with other indicators like the moving average and the RSI. Also, you should use other tools like the hanging man, triangle, and Doji patterns. Therefore, if the line crosses minus 50, it means that prices are trading in the upper section of their high-low range and vice versa. The indicator is located at the bottom of the chart with its “0 to -100” scale depicted on the right. No indicator is perfect, but the proper use of them can always provide an edge, and that edge is all that is required for a trader to be successful over time.

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. When trading with the Williams %R, it is important to remember that overbought or oversold signals do not necessarily mean that a market’s overall trend is going to reverse. The Williams %R calculation uses the highest high in the last 14 periods, the lowest low in the last 14 periods and the most recent closing price. The number of periods can be 14 seconds, minutes, hours, days or months – although 14 days is the most common. If we look at the first set of Green circles, the R% dipped below the “-80” line before prices reversed to form a new uptrend.

How to Trade Forex Using the Williams %R Indicator

The next thing you can change is the color of the indicator. You could change the line color and the overbought and oversold levels. There are two main things that you can change in its settings. While the default period of the indicator is 14, you can change it to match your trading strategy.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Things to bear in mind when trading with the Williams %R

During a strong uptrend, the price will often reach -20 or above. If the indicator falls, and then can’t get back above -20 before falling again, that signals that the upward price momentum is in trouble and a bigger price decline could follow. Can be used to generate trade signals when the price and the indicator move out of overbought or oversold territory.

When the indicator can no longer reach those low levels before moving higher it could indicate the price is going to head higher. The same concept could be used to find short trades in a downtrend. When the indicator is above -20, watch for the price to start falling along with the Williams %R moving back below -20 to signal a potential continuation of the downtrend.

We have looked at how to calculate and how to interpret the Williams %R indicator. Partner with ThinkMarkets today to access full consulting services, promotional materials and your own budgets. Harness past market data to forecast price direction and anticipate market moves.