Moreover, the techniques you learn here can be transferred to any other type of market. In the first part of this series, we will explain the basic concepts of price action trading. A lot of theories and strategies are available on price action trading claiming high success rates, but traders should be aware ofsurvivorship bias, as only success stories make news. It is up to the individual trader to clearly understand, test, select, decide and act on what meets the requirements for the best possible profit opportunities.

But are reversal trading strategies really inferior, riskier and should be avoided? The MACD indicator is a popular momentum and trend-following indicator that is based on the information of moving averages and, thus, is ideal to act… The first choice is to draw a line from low to high and the other is vice versa. The levels that are depicted with the use of the Fibonacci Retracements are 23.6%, 38.2%, 50%, 61.8%, and 100%. However, if there is a strong trend in the market the highest level that is being reached is usually 38.2%.

Will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. We know from a chapter about the trends that the upward trend is characterized by a series of higher highs and higher lows, while the downward trend is characterized by lower lows, followed by lower highs. If we identify a trend, the principle is to always trade in the direction of the trend, which is more likely to succeed than trading against the trend. Most importantly, the traders feel in charge, as the strategy allows them to decide on their actions, instead of blindly following a set of rules. A doji is a trading session where a security’s open and close prices are virtually equal.

The current trend will stop after some time, a consolidation will occur and then a new trend will start. A reverse formation that forms at the top of a move is called a distribution, where active selling of the instrument occurs. On the other hand, the formation that forms at the lower levels is accumulation, which is the area where active purchases will occur. On the other hand, the corrective movementis a movement where the candlesticks are usually shorter and they often alternate. The corrective movement follows the impulsive movement and is usually directed against it.The corrective movement is used for timing the trade in the direction of the previous impulsive movement.

Price action strategy: a complete guide for traders

Price action traders may spot a trend that can lead them to high profits, that users who implement indicators may not see because of the complexity of their charts. In this article, we will define what Price Action Trading strategy is and explain the trading tools that PAT embodies and how they can be applied. Moreover, we will provide a brief guide on how to read the price action as well as which indicators and techniques it includes. Based on this, we can then identify impulsive movements and corrections. Once you learn how to read these market patterns, you will clearly know what you are looking for in the market and therefore it will be easier for you to determine the parameters of the trade.

If the trader identifies a significant impulsive movement, he will try to trade in that direction. Price action signals – sometimes called price action patterns, or price action triggers – are easily-recognisable patterns in a market, which can be used to predict future market behaviour. Experienced traders can sometimes spot these signals at a glance by recognising certain shapes or repetitions in past performance. Interpretations given to different price action patterns are subjective. Apart from seeing technical indicators as unnecessary, they also believe that indicators respond to price and that the information they provide only results from what price does. They respond to the price late and would rather confuse price action traders by complicating decision-making.

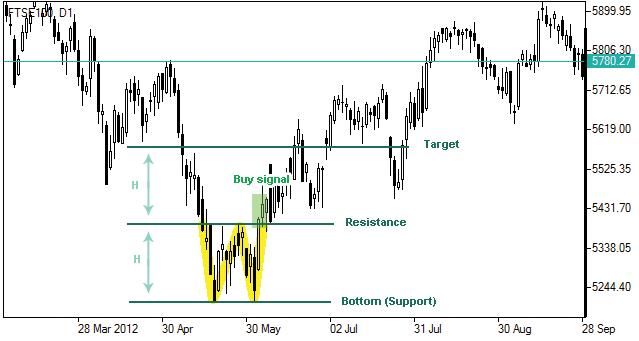

This type of trading tool monitors any major trend movements in the market. A breakout can occur when the market moves over or below the limits of support and resistance levels. Breakouts can be either small or big and can occur in various patterns such as triangles, head and shoulders, ranges, and flag patterns.

Resistance refers to a level that the price action of an asset has difficulty rising above over a specific period of time. Price action is often depicted graphically in the form of a bar chart or line chart. The first is to identify the direction of the price, and the second is to identify the direction of the volume. Traders who follow price action may use minimal technical indicators or avoid them altogether.

Different candlestick patterns are formed as the price moves up and down. Although the formations look random, they are usually sufficient to give cryptocurrency traders the information needed to understand what is happening in the market. The Pin Bar is an efficient trading strategy tool that helps traders to understand the size of the price that was discarded due to a sharp trend reversal.

Introduction to Price action I: What you need to know before you start

Many traders use candlestick charts to plot prior price action, then plot potential breakout and revering patterns. Although prior price action does not guarantee future results, traders often analyze a security’s historical patterns to better understand where the price may move to next. On the other hand, some price action traders use technical indicators to serve as confluences for their strategies.

Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Should a security’s price be moving upward while the volume increases, this means there is strong conviction in the market as many investors are buying at the increasing price. Alternatively, should there have been low volume, the price action may not be as convincing as not many investors are choosing to invest at the current pricing levels. You can also create a hybrid or custom approach that focuses on price action, but also includes a few technical or fundamental indicators. You can also study a smaller range of sessions by analyzing groups of bars, such as the bullish engulfing candlestick pattern . Indicators were designed to emphasize certain technical aspects of the markets .

For example, some use the moving average, especially the exponential moving average, since it responds faster to recent price movements than the simple moving average, to get confluences for price support. The confluences serve as additional confirmations for trade entry and exit. Most traders believe that the market follows a random pattern and there is no clear systematic way to define a strategy that will always work. The general definition of the Price Action Trading strategy embodies the monitoring of highs and lows sequence.

For example, if the pin bar pattern has a long lower tail, this tells the trader that there has been a trend of lower prices being rejected, which implies that the price could be about to rise. Technical analysis uses a range of different calculations to predict future price movements. By contrast, price action relies only on the price movements of an asset within your trading timeframe. It forms the basis of all technical analysis, as technical analysts use past and present price information to make trading decisions. Trading with NAGA Trader by following and/or copying or replicating the trades of other traders involves high levels of risks, even when following and/or copying or replicating the top-performing traders.

An Introduction to Price Action Trading Strategies

Before making an investment decision, you should rely on your own assessment of the person making the trading decisions and the terms of all the legal documentation. In the chart below, any trader from the most experienced to the newest one can spot different trending directions as well as recent swings in the price. Thus, a strong buy position can be advised in the spots that are marked with a red circle so the trader will benefit from the uptrend.

Price action forms the basis for all technical analyses of a stock, commodity or other asset charts. As with all technical trading approaches, price action analysis is a blend of art and science. But if it resonates with the way you prefer to analyze and trade markets, then perhaps this discipline is worth a try. Price action trading is a method of financial analysis and speculation that generates its insights and actions solely from the interpretation of price movements. Traders can use this as a signal to act, taking a long position if the stock is trending upwards or breaks above the resistance line, or a short position if it moves below the support line. The forex market is particularly popular with price action traders for a few reasons.

Price action is one way to analyze and read the market movements of various instruments. The method is applicable to all markets and it is one of the most widely used methods. From a perspective of a forex trader, price action means trading purely according to a price chart without technical indicators.

What Is Price Action Trading? 3 Price Action Charts Explained

Though many use price action to forecast future prices, prior price action does not guarantee future results. Price is king but what does it take to trade price action successfully and why do so many traders struggle with it? However, at the beginning, it requires much effort to study and gain knowledge to understand its patterns.

This is why traders often combine indicators—to compensate for gaps in technical perspective. This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.