In the past, the forex market was dominated by institutional firms and large banks, which acted on behalf of clients. But it has become more retail-oriented in recent years—traders and investors of all sizes participate in it. You’ll often see the terms FX, forex, foreign exchange market, and currency market. Any news and economic reports which back this up will in turn see traders want to buy that country’s currency. A short position refers to a trader who sells a currency expecting its value to fall and plans to buy it back at a lower price. A short position is ‘closed’ once the trader buys back the asset .

For instance, if you wish to buy a product from a foreign country you would normally go to a store near you in order to purchase or order it, right? But for that to be possible, the store would have needed to import the goods from that foreign country. With this, many currency speculators depend on the availability of enormous leverage in order to increase the value of any potential movements. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

There are four traditional majors – EURUSD, GBPUSD, USDJPY and USDCHF – and three known as the commodity pairs – AUDUSD, USDCAD and NZDUSD. This means they often come with wider spreads, meaning they’re more expensive than crosses or majors. It is the smallest possible move that a currency price can change which is the equivalent of a ‘point’ of movement.

Best Time of Day to Trade

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange marketsprovide a way tohedge currency risk by fixing a rate at which the transaction will be completed. A trader can buy or sell currencies in the forwardor swap markets in advance, which locks in an exchange rate. FXTM firmly believes that developing a sound understanding of the markets is your best chance at success as a forex trader. That’s why we offer a vast range of industry-leading educational resources in a variety of languages which are tailored to the needs of both new and more experienced traders.

You may want to test the environment with virtual money with a Demo account. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing.

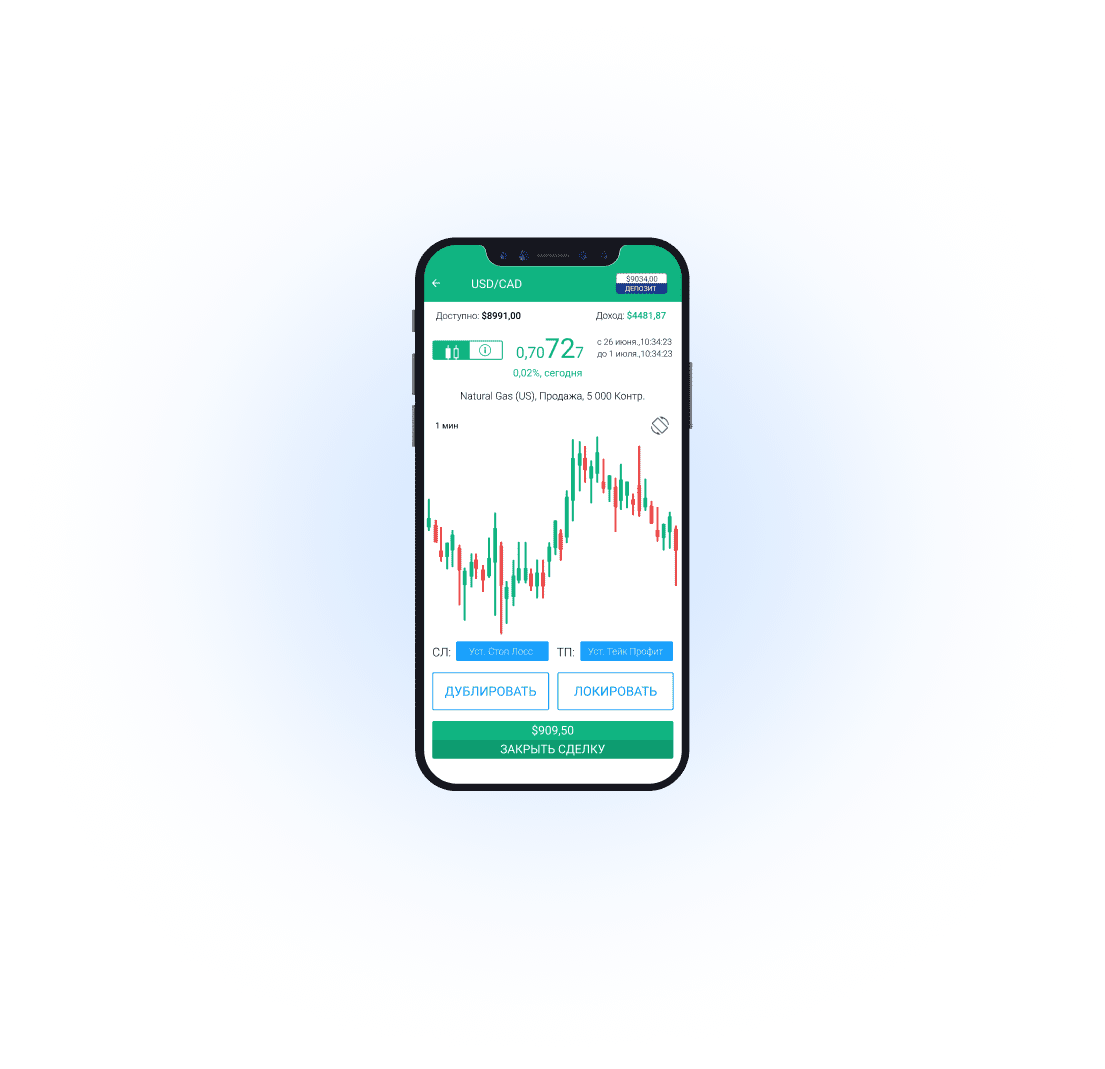

The upper portion of a candle is used for the opening price and highest price point of a currency, while the lower portion indicates the closing price and lowest price point. A down candle represents a period of declining prices and is shaded red or black, while an up candle is a period of increasing prices and is shaded green or white. Like other instances in which they are used, bar charts provide more price information than line charts. Each bar chart represents one day of trading and contains the opening price, highest price, lowest price, and closing price for a trade. A dash on the left represents the day’s opening price, and a similar one on the right represents the closing price. Colors are sometimes used to indicate price movement, with green or white used for periods of rising prices and red or black for a period during which prices declined.

However, due to the heavy use of leverage in forex trades, developing countries like India and China have restrictions on the firms and capital to be used in forex trading. The Financial Conduct Authority monitors and regulates forex trades in the United Kingdom. Banks, brokers, and dealers in the forex markets allow a high amount of leverage, meaning traders can control large positions with relatively little money.

FXTM offers hundreds of combinations of currency pairs to trade including the majors which are the most popular traded pairs in the forex market. These include the Euro against the US Dollar, the US Dollar against the Japanese Yen and the British Pound against the US Dollar. No matter what your style, it is important you use the tools at your disposal to find potential trading opportunities in moving markets. The minor currency pairs are also commonly referred to as cross-currency pairs or simply “crosses”. Minor currency pairs are known to have slightly wider spreads and are not as liquid as the majors but still sufficiently liquid markets.

This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading. Knowing the best time of day to trade on the Forex markets can be crucial to your trading success. Forex trading has become increasingly accessible and can be traded 24 hours a day. The Forex markets are the largest and most liquid financial markets in the world.

Get Started

Pricing, execution, and the quality of customer service can all make a difference in your trading experience. By following your trading plan, exit the market at your forecasted limits. Think about how you performed, so that you can improve after each trade you make. With this, even if the trading day in the U.S. ends, the forex market in Tokyo or Hong Kong begins anew.

Forex, foreign exchange, or simply FX, is the marketplace where companies, banks, individuals and governments exchange currencies. It’s the most actively traded market in the world, with over $5 trillion traded on average per day. When trading currencies on the foreign exchange market, currency pairs are often split into major, minor and exotic currency pairs.

How do I learn forex trading?

The forex market is where banks, funds, and individuals can buy or sell currencies for hedging and speculation. Trading currencies productively requires an understanding of economic fundamentals and indicators. Leveraged trading can make forex trades much more volatile than trading without leverage. The forex market is more decentralized than traditional stock or bond markets.

Exotic currency pairs

He top of the bar shows the highest price paid, and the bottom indicates the lowest traded price. A point in percentage – or pip for short – is a measure of the change in value of a currency pair in the forex market. This ‘currency pair’ is made up of a base currency and a quote currency, whereby you sell one to purchase another. The price for a pair is how much of the quote currency it costs to buy one unit of the base currency.

Winning Forex Strategies

According to a 2022 triennial report from the Bank for International Settlements , the daily trading volume for forex reached $7.5 trillion in 2022. Master the basics of forex trading even if you have no trading experience. A bar chart shows the opening and closing prices, as well as the high and low for that period.

All of the existing major currency pairs have the U.S. dollar on one side, either as the base currency or the quote currency. They are considered to be the most traded pairs in the foreign exchange market. For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than in other markets. For those with longer-term horizons and more funds, long-term fundamentals-based trading or a carry trade can be profitable.