As you open a trade, equity shows how your balance is changing in real time. Once the trade is closed, the equity becomes the trading balance. Forex trading is a leveraged activity, which means that traders are using borrowed funds from their broker to increase purchasing power. Margin helps traders understand how many additional trades they can open. You should definitely keep an eye on your overall account equity to make sure that your trading account is not heading into negative territory as a result of losing trades. This situation can result in an untimely and usually very unprofitable closeout of all your trading positions if your online broker implements such a safeguard.

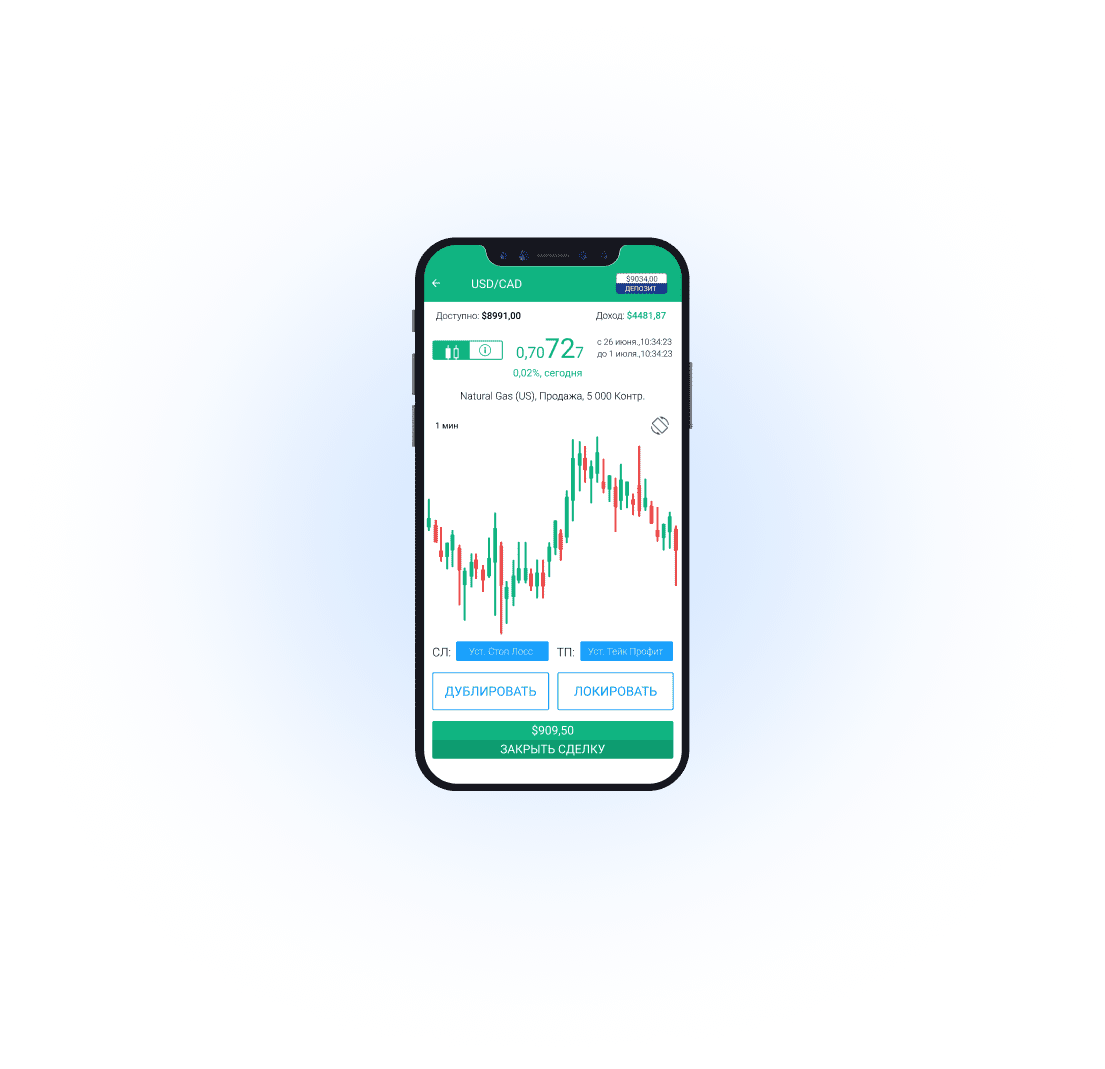

It will immediately see that you have now a larger balance but no trades open, so the balance will be equal to the equity. The Equity reflects the real-time calculation of your profit/loss. The Equity takes into account both open AND closed positions. That’s why Equity is seen as a “floating account balance“. It will only become your “real account balance” if you were to close all your trades immediately.

Your forex trading account’s equity is roughly equal to the amount of cash you would have left over if you liquidated all open trading positions at current market exchange rates. If you have no open trading positions, then your account equity is equal to your account balance. If your forex trading account’s equity is negative, then you will have lost all of your margin deposit and then some if you close out all of your positions at the current market levels.

What is Free Margin?

The magazine provides the reader with up- to date news, reviews, opinions and polls on leading brands across the globe. The margin will be released back to you regardless if you win or lose on your trade. The notification about the need to top up your account to avoid closing positions is called Margin Call. Exinity Limited is a member of Financial Commission, an international organization engaged in a resolution of disputes within the financial services industry in the Forex market.

In most cases, it is in the bottom-left corner of the terminal. If you’re using MT4, then it will most likely show as colored text right next to your balance. Free margin is your available balance, and margin held is how much your open trade is worth. Used Margin is the total amount of margin that’s currently “locked up” to maintain all open positions. Learn why it’s important to understand how your margin account works. For example, if your Balance is $1,000, and you have an open trade that has a floating loss of $900.

Example: Account Equity When an Existing Trade is Losing

To make money, you should focus on price action, technical and fundamental analysis and not on equity. Many traders open single positions and stare at equity numbers, praying for the price to go positive. A single trade should never become so significant that it takes all the energy and attention of a trader. When you have a good risk management in place, you can open various orders simultaneously. Staring on the equity numbers instead of searching additional trading opportunities is a terrible idea.

If you subtract the margin from the equity, you will calculate free margin, which could be used to enter new trades. If there is not enough free margin to hold the positions open, the broker will first send you a notification that you must top up your balance. If you ignore this notification and the market goes against you, the broker will close all your positions forcibly. Equity in forex is largely determined by the floating open position.

Equity is both your account balance and your future account balance. It calculates how much you can potentially have after closing all active trades. Your account balance is the cash you have available in your trading account. Equity is your account balance plus the floating profit of all your open positions. If you have open positions, your Equity is the sum of your account balance and your account’s floating P/L. The account equity or simply “Equity” represents the current value of your trading account.

For example, they might wait for a trade to reach an equity level of $100 to close out a winning position they have entered. However, this is not an ideal way to trade since your market analysis should really take precedence over just looking at your account or position equity numbers. Unrealized gains and losses reflect changes in valuation attributed to open forex trading positions. They are computed by comparing the trade entry exchange rate to the present market exchange rate. While trading, it’s not uncommon for traders who are starting out to get confused between their balance and their equity. While they can sometimes reflect the same amount, Balance and Equity refer to two different amounts.

The account or trade equity you have in your forex trading account refers to the total current value of your margin account. This equity measure is equivalent to your account’s balance plus or minus gains or losses from open positions you are running. When your open positions lose money and your equity decreases, you become under psychological risks. Most traders compare their trading balance and equity and plan to get out of trades when they’re even, in other words, equity and balance become close to each other. It’s always best to take a small loss than to move the stop loss away from the original point. Some traders might use their account equity to determine when they should exit their trading positions.

Adding to a losing position typically leads to a disaster, more losses and blown up accounts. Usually, when your account equity drops below the margin requirement, all open positions will be automatically closed by the broker. Other brokers will also send you margin alerts before so the trader can liquidate all positions. Equity in Forex trading refers to the account balance plus the unrealised profit or loss from your open positions. The account equity refers to the total amount of money the account. Online forex traders should also monitor their margin account’s equity to make sure it does not approach the point where their broker will automatically close out their positions.

What is the difference between Balance and Equity?

Equity is the current value of the account and fluctuates with every tick when looking at your trading platform on your screen. Global Brands Magazine is a leading brands magazine providing opinions and news related to various brands across the world. A fully autonomous branding magazine, Global Brands Magazine represents an astute source of information from across industries.

The account equity measure marks the value of your trading positions to the foreign exchange market in real-time and then adds that amount to your cash balance. Forex traders can look at their current account equity to determine if they should prudently take on additional risk, sit tight or close out some positions to reduce their risk. Account equity shows the temporary current value of a trading account given present market exchange rates. Also, phrases like forex equity and trade equity refer to the amount of cash you would have left in your brokerage account if you closed out all forex positions at current market levels. Equity in Forex simply tells traders how much money they currently have when trading orders are active. Equity equals trading balance +/- current profits or losses from active trades.

In case, for some reason, you think that the equity on your account is wrong, then the best thing to do is contact the broker and ask a professional to give it a look. Naturally, the broker may stop it themselves if there is leverage or any other resource being used. But if it’s on its own, then there is a good chance the broker won’t touch it. If your account is “flat” or does NOT have any positions open, then your Balance and Equity are the SAME.

The difference between equity and balance in Forex

But if you do have open positions, this is when the Balance and Equity differ. Since you haven’t opened any trades yet, your Balance and Equity is the same. If you do NOT have any open positions, then your Equity is the same as your Balance.

A margin call refers to the situation when the margin in an account is depleted and requires either to be funded further by the trader or the position to be closed. The margin is multiplied by leverage to determine the lot size. The margin is a real money amount from your trading account. If we try to look up the word in the dictionary, the closest in meaning synonym will be capital. The capital means not only the current balance but also the profit from the financial assets you have invested in.

Trading strategy based on the KST indicator

Let’s say you had $10,000 when you started the trade, and now are in $500 profit. Your account balance would still be $10,000, but your FX equity would be $10,500. The system understands that you can close the trade at any time and increase your balance, so it does the calculation before you actually close. The trader then opens up two positions at present market rates.

The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. This article is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. Investing involves risk regardless of the strategy selected and past performance does not indicate or guarantee future results. Trading leveraged products such as Forex and Cryptos may not be suitable for all investors as they carry a degree of risk to your capital. Equity reflects the current situation on all opened positions of a trader.

The equity value of an account is higher than its balance when its open positions are showing an unrealized profit. Conversely, the equity value of an account is lower than the balance when its open positions show an unrealized loss. The balance reflects the profit/loss only from closed positions. The open positions and margin are not included in the balance.

After logging in you can close it and return to this page. Forcible closing the position by the broker because of the shortage of free assets is called Stop out. FXTM brand is authorized and regulated in various jurisdictions. Required Margin is the amount of money that is set aside and “locked up” when you open a position.